Gateway Survey & Planning is now a registered Transfer Duty Self-Assessor with the Queensland Revenue Office!

What is transfer duty?

Commonly referred to as stamp duty, transfer duty is a tax payable to the State for particular transfers of property, including land. A number of factors determine whether a transfer is a dutiable transaction under the Duties Act 2001 (Qld). A dutiable transaction requires assessment to determine if any stamp duty is payable.

» Learn more about transfer duty

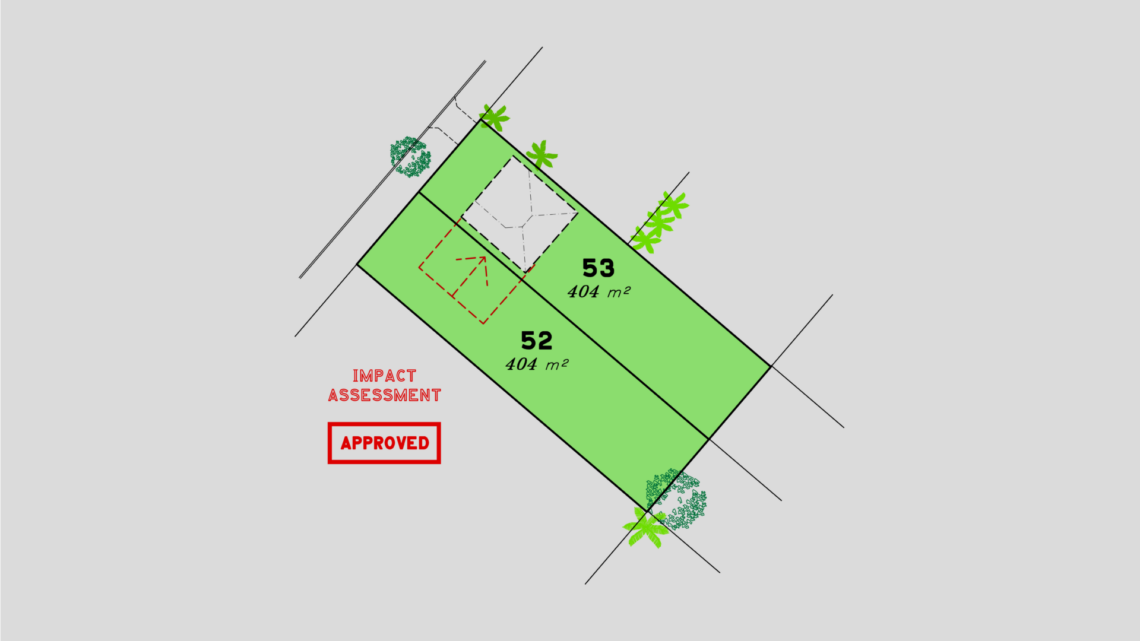

In most cases, a simple subdivision in itself does not constitute a dutiable transaction. Transfer duty will be assessable when the new lots are sold or if the ownership is otherwise changed.

For development with potentially complex stamp duty implications, it is imperative to work with your solicitor or accountant to ensure all applicable duties are accounted for.

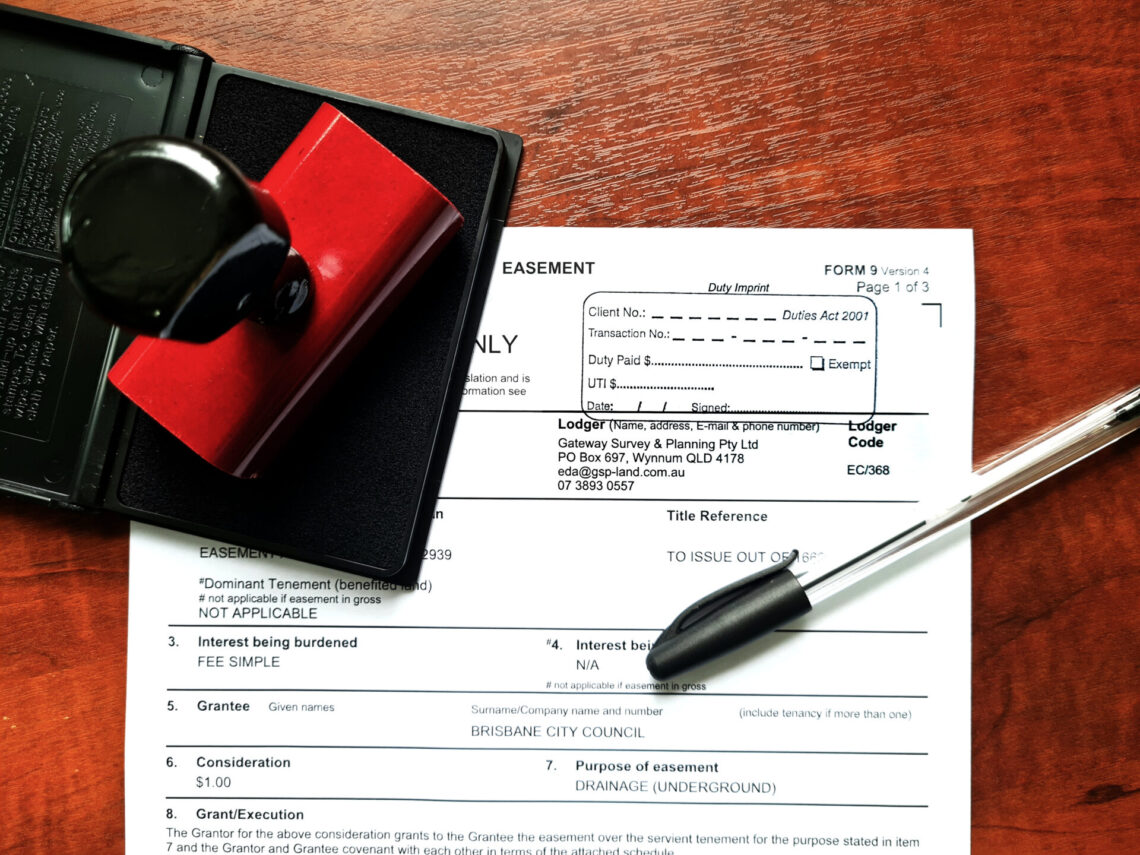

Transfer duty on easements

Many subdivisions involve the creation of easements for various purposes including access, services, stormwater drainage, or flooding.

Creating or changing an easement is a dutiable transaction as it involves the acquisition of a new right. The right to use that land for the stated purpose is transferred from the owner of the underlying lot to the beneficiary of the easement (either another lot owner or a public authority).

Access easements internal to a subdivision (e.g. for shared access or a rear lot) and easements in favour of public authorities (e.g. Council, Urban Utilities, Unitywater) are typically assessed with no duty payable. However, this can only be determined by the Queensland Revenue Office or a registered Transfer Duty Self-Assessor and a duty imprint (stamp) must be applied to the easement document prior to lodgement with the titles office.

Our registration

Our registration for transfer duty assessment streamlines the process of finalising easements for plan sealing and titling.

Currently, Brisbane City Council requires all easements in its favour to be stamped prior to plan sealing. Having our clients send easement documents to a solicitor or the Queensland Revenue Office before then returning them to our office or to Council was a convoluted process and often resulted in delays to plan sealing or missing documents. We can now take care of stamping, track the process better, and make sure everything is provided back to Council in a reasonable timeframe.

The ability to stamp easements also means we can obtain titles for subdivisions more quickly and easily.